This graphic represents into whose pockets/coffers where the $$ that the pt pays at the register ends up going. I think that this proposal clearly explains the power of those companies who has the largest pots of money to pay lobbyists to convince Congress and members of the Administration as to what the big corporations want those bureaucrats to believe as what the corporation wants them to believe as “the truth”. This is a settlement from the PBM Centene with Indiana Medicaid – just this month – for overcharging the state Medicaid Centene will pay Indiana $66.5 mln to settle Medicaid overcharge allegations

This graphic represents into whose pockets/coffers where the $$ that the pt pays at the register ends up going. I think that this proposal clearly explains the power of those companies who has the largest pots of money to pay lobbyists to convince Congress and members of the Administration as to what the big corporations want those bureaucrats to believe as what the corporation wants them to believe as “the truth”. This is a settlement from the PBM Centene with Indiana Medicaid – just this month – for overcharging the state Medicaid Centene will pay Indiana $66.5 mln to settle Medicaid overcharge allegations

Centene said in its most recent quarterly filing with the U.S. Securities and Exchange Commission that it had settled with 13 states, was in talks with others and had set aside $1.25 billion to resolve related claims.

Pharmas, wholesalers, Pharmacies all have the business cost of keeping a inventory. The insurance/PBM has COMPUTERS as the primary business overhead. The pharmas & wholesalers have shipping cost of product to their customers and the PBM charges the Pharmacies $0.25 per Rx electronic submission. So the FEDS are going after the part of the Rx distribution system, which may have the highest cost of doing business and the lowest net profits… while ignoring the part of the distribution system with the highest net profit.

Just remember their is no prerequisite experience nor educational qualification/certification to become an elected or un-elected bureaucrat

Medicare announces plan to recoup billions from drug companies

https://www.npr.org/sections/health-shots/2023/02/09/1155804068/medicare-releases-a-draft-of-its-new-prescription-drug-pricing-rules

Medicare’s historic plan to slow prescription drug spending is taking shape. Thursday federal health officials released proposed guidance that outlines the first of a pair of major drug price reforms contained in the Inflation Reduction Act. Those reforms are projected to save Medicare roughly $170 billion over the next decade.

President Joe Biden touted the effort underway earlier this week in his State of the Union address. “We’re taking on powerful interests to bring your health care costs down so you can sleep better at night,” he said.

Spending on drugs in Medicare, which covers 64 million seniors and people with disabilities, nearly tripled from about $85 billion in 2009 to $240 billion in 2020. Medicare spends an average of $2,700 per beneficiary on retail drugs each year.

A team of roughly two dozen analysts, economists and other technical experts within the Centers for Medicare & Medicaid Services is now knee-deep in the painstaking process of translating the administration’s lofty law into ironclad policy.

This story was produced by Tradeoffs, a podcast exploring health care policy.

The new details released Thursday outline how Medicare will use its new authority to claw back refunds from drugmakers for price increases that outpace the rate of inflation.

Dr. Meena Seshamani, director of the Center for Medicare, called the guidance “an important step in our work to lower out-of-pocket drug costs and strengthen the sustainability of the Medicare program for current and future enrollees.”

The agency is bracing for its work to face legal attacks, gamesmanship and lobbying from a formidable opponent: the pharmaceutical industry. The looming battle between bureaucrats and industry will help determine how much money Medicare saves.

CMS is staring down several challenges. The first is timing.

The authors of the Inflation Reduction Act, which armed Medicare with these new powers last August, gave the agency just a few months to finalize policy details.

“Congress has pushed them very hard,” said Richard Frank, a senior fellow at the Brookings Institution who served in HHS under President Obama. “They’re building the ship and trying to sail it at the same time.” To address that pressure, the agency is hiring furiously, working to add another 75 people to its new group overseeing this effort.

Drug companies, which spent $160 million lobbying the government last year, have their own teams working tirelessly. “We are definitely not sitting on our hands,” said Alice Valder Curran, who advises drug companies on pricing strategy at law firm Hogan Lovells. “We’re going to scour the guidance.”

Curran said companies have spent the months since the Inflation Reduction Act passed analyzing its potential impact on drugs they sell now – and those in their pipelines. With today’s release of draft rules, she added, companies can now begin to answer their questions about how the law will be implemented.

Medicare targets drugmakers who hike prices too fast

The new plan to lower drug prices announced Thursday requires drugmakers to refund Medicare for any price increases that outpace the rate of inflation.

“The inflation rebate program intends to hold drug companies accountable,” said Medicare’s Seshamani.

Inflation rebates are expected to deliver $70 billion in savings over the next decade on a large number of drugs – potentially more than 1,000, according to the Kaiser Family Foundation. “We’re talking about the same drug from one year to the next – no change to the product – but the price goes up in many cases 10 percent, sometimes even higher,” said Juliette Cubanski, deputy director of the program on Medicare policy at KFF.

The inflation rebate, with its clunky name and complex formulas, has caught less attention than Medicare’s other major new authority to cut drug spending by negotiating directly with drugmakers, which CMS intends to lay out in detail this spring.

That negotiation power is unprecedented and will target some of the country’s biggest ticket drugs, starting with 10 blockbusters in 2026. The number of negotiated drugs will grow to 60 by the end of this decade, and will save Medicare nearly $100 billion by 2031.

Combined, these two new powers represent Medicare’s antidote to drugmakers continuing to raise prices, particularly on products that have no competition.

Potential loopholes jeopardize size of savings

The guidance answers important mechanical questions about these rebates. For example, beginning April 1, some refunds will be passed directly on to seniors, lowering their out-of-pocket costs for certain drugs, which could include expensive cancer treatments. The guidance outlines exactly how those rebates will be calculated, passed through providers and into people’s pockets – no small logistical feat.

Also tucked inside the 71 pages of guidance are details that highlight potential loopholes in the law that could be exploited by drugmakers, representing another key challenge CMS faces in maximizing savings.

Anna Kaltenboeck, who helped craft the Inflation Reduction Act as a senior health advisor to the U.S. Senate Committee on Finance and is now a principal at the health research firm ATI Advisory, said lawmakers and regulators tried to learn from other federal programs that use inflation rebates.

Medicaid, which covers 82 million low-income Americans, has clawed back very similar inflation rebates for 30 years. While doing so has effectively lowered Medicaid’s spending, drugmakers have successfully avoided hundreds of millions of dollars in payments by taking advantage of flexibilities built into the law. Similar gamesmanship could be magnified in Medicare, which spends three times more on drugs than Medicaid.

While Kaltenboeck believes Medicare’s inflation rebate rules effectively close some known loopholes, she admits others may be lurking. “There are almost an infinite number of ways [that] a manufacturer might think of to evade these new policies,” Kaltenboeck said.

The Office of Inspector General for the Department of Health and Human Services has said it’s on high alert and has published multiple reports warning about potential weaknesses in the rebate law.

Finally, industry advisor Curran said, this new guidance also offers a first highly anticipated look at the federal government’s broader philosophical approach to wielding its pair of new powers. “Everyone is going to be reading the tea leaves – are they being strict or less strict – and trying to draw conclusions from that.”

The rebate law gives Medicare discretion to reduce or waive rebates for companies whose drugs experience shortages or a supply chain disruption. If, for example, an earthquake hits a company’s lone manufacturing plant, they may need to hike prices to recover economically and invest in plant upgrades. But a waiver that is too lenient, said economist Richard Frank, could also incentivize bad behavior by manufacturers. “You’re trying to find that balance.”

Industry turns its attention toward negotiation

The public has until March 11 to comment on the details released Thursday, after which Medicare will revise and publish final guidance on the inflation rebate provision. “It’s very important to us to hear from all interested parties and incorporate all of those perspectives and expertise and experiences as we thoughtfully implement this law,” said Medicare’s Seshamani.

Medicare now turns its attention to finalizing and publishing similar guidance on price negotiation. It’s an authority the industry is still surprised lawmakers managed to pass. “We’re having to wrestle with responding to guidance about something we never thought was going to happen,” said Jenny Bryant, Executive Vice President for Policy and Research at the industry trade group PhRMA.

Bryant said the forthcoming guidance, which targets some of the industry’s top sellers, has the group’s full attention. “Our energy is going into thinking about this completely novel thing we know extraordinarily little about how the agency is going to approach.”

Many experts believe that manufacturers will comb through those details looking not only for loopholes, but also for ammunition. “Manufacturers are absolutely going to be looking to mount a legal challenge,” said former Senate advisor Kaltenboeck. PhRMA said it expects pressure for legislative change to grow too.

Those legal stakes are one more reason people like former HHS official Richard Frank worry about the agency moving so fast through such technical work. The Affordable Care Act , the last health care law this consequential, was also written and implemented in a hurry. A few words mistakenly included in the final language of that law ultimately landed it before the Supreme Court.

“I do think the lessons learned from the ACA are fresh on people’s minds,” Richard Frank said.

Seshamani, who helped implement the ACA, said that’s why the agency has “set up monthly technical calls with drug manufacturers [and] regular strategic policy meetings with patients groups, providers [and insurance] plans.”

Dan Gorenstein and Leslie Walker are producers with Tradeoffs, a podcast exploring health policy.

Like this:

Like Loading...

Filed under: General Problems | Leave a Comment »

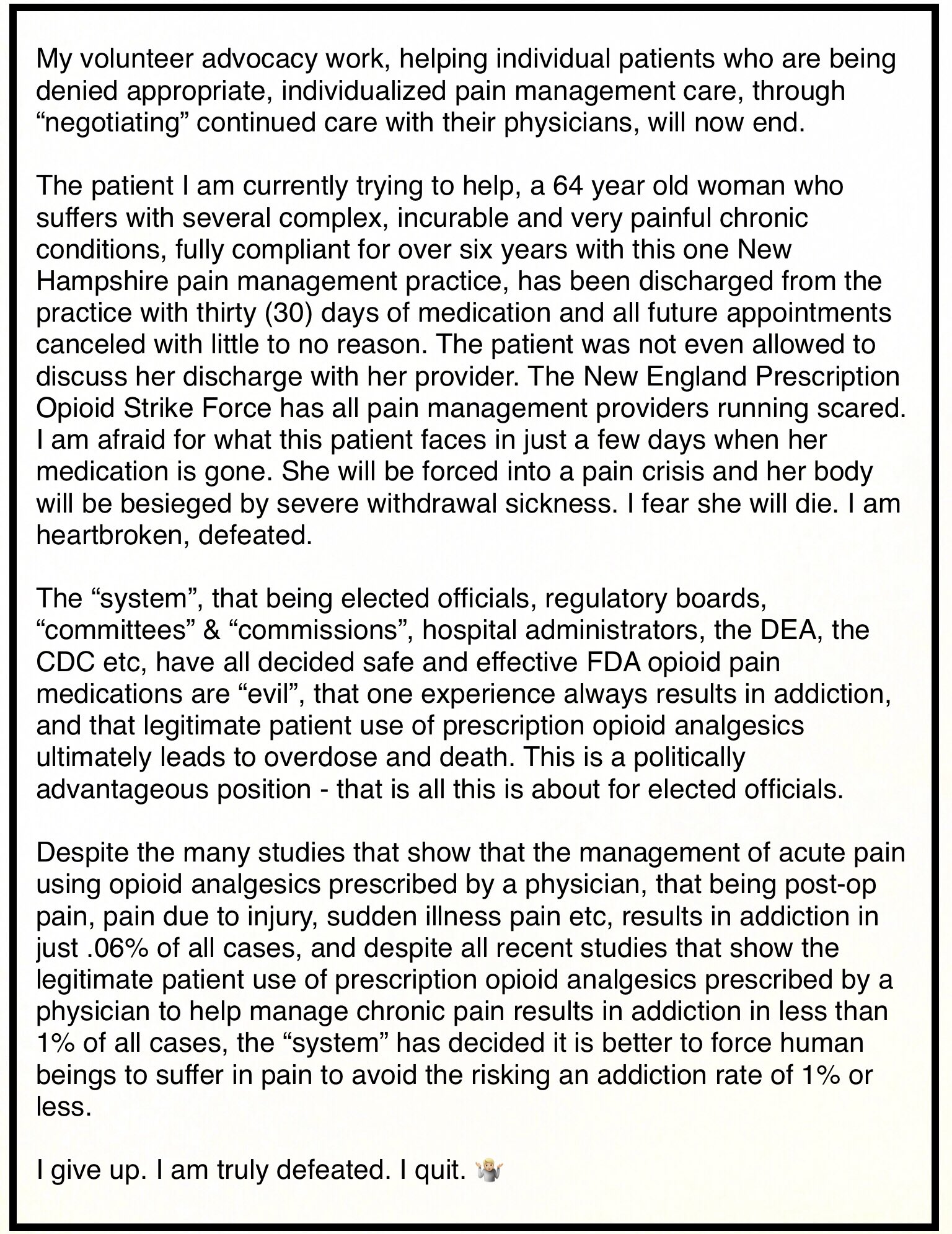

Every time that I sit down at my desk, I am reminded of a couple of movies GROUND HOG DAY and ALICE IN WONDERLAND

Every time that I sit down at my desk, I am reminded of a couple of movies GROUND HOG DAY and ALICE IN WONDERLAND  here is a chart of possible complications to a pt’s comorbidity issues from under/untreated pain.

here is a chart of possible complications to a pt’s comorbidity issues from under/untreated pain.